- [email protected]

- +86-21-63353309

development costs are not recognized as an asset in a mining company

development costs are not recognized as an asset in a mining company

How to Account for Intangible Assets under IAS 38 - CPDbox

You can capitalize the expenditures for development only when all 6 criteria are met - not before. Also, you cannot capitalize it retrospectively. Just as an example, let's say that you incurred CU 5 000 for development in May 20X1 and further CU 10 000 in September 20X1.

Learn MoreAASB 138 - Intangible Assets - Legislation

Internally Generated Intangible Assets 51 - 53 Research Phase 54 - 56 Development Phase 57 - 64 Cost of an Internally Generated Intangible Asset 65 - 67 Recognition of an Expense 68 - 70 Past Expenses not to be Recognised as an Asset 71 Measurement After Recognition 72 - 73 Cost Model 74 Revaluation Model 75 - 87 Useful Life 88 - 96

Learn MoreIFRS 6 EXPLORATION FOR AND EVALUATION OF MINERAL

and evaluation assets (the list is not exhaustive): successful development or by sale. Exploration and evaluation expenditures recognised as assets

Learn MoreDevelopment Cost Definition: Everything You Need to Know - UpCounsel

Companies may experience trouble with research and development expenditures because future benefits cannot be guaranteed. Also, it is difficult to attach an expenditure to an asset. Because of these uncertainties, companies have a requirement to charge expenditures directly to the expense from which it incurred.

Learn MoreSolved Schefter Mining operates a copper mine in Wyoming.

Transcribed image text: Schefter Mining operates a copper mine in Wyoming. Acquisition, exploration. and development costs totaled $8.5 million. Extraction activities began on July 1, 2018. After the copper is extracted in approximately sik years. Schefter is obligated to restore the land to its original condition, including constructing a park.

Learn MoreAsset Acquisition Accounting - The CPA Journal

If the acquisition of an asset or asset group (including liabilities assumed) does not constitute a business, however, the transaction is no longer a business combination and the acquirer accounts for it as an "asset acquisition.". An asset acquisition transaction uses a cost accumulation model, whereas a business combination within the

Learn Moref2 Flashcards | Quizlet

software costs that are research and development (3) 1. planning 2. design 3. substantial testing of initial stages total payroll tax liability = 1. total wages x FICA tax rate = FICA tax withheld (employee) 2. plus Federal income withheld = total tax withheld 3. plus employer fica tax expense and liability = total payroll liability R&D

Learn MorePDF Financial reporting in the mining industry International ... - PwCPDF

evaluation, development and production of mineral resources continues. This publication does not describe all IFRSs applicable to mining entities but focuses on those areas that are of most interest to companies in the sector. The ever-changing landscape means that management should conduct further research and seek specific

Learn MoreIFRS for mining

IFRS for mining | IFRS 16 Leases – Practical application guidance Companies should not underestimate the definition, a company should develop an.

Learn MoreCost of Property, Plant and Equipment (IAS 16

06/06/2022 · Amendment effective from 2022: IASB amended IAS 16 so that all income generated during development of PP&E should be recognised in P&L. Decommissioning costs The estimate of the costs of dismantling and removing the item and restoring the site on which it is located is recognised as a provision and added to the cost of PP&E.

Learn MoreFinancial reporting in the mining industry International ... - PwC

Most mining entities recognise the cost incurred to find and develop mineral reserve and resource assets on the balance sheet at historical

Learn MoreGood Mining (International) Limited - EY

The Group is a fictitious, large publicly listed mining company. only expenditures that result in a recognised asset in the statement of

Learn MoreIFRS and the mining industry - IAS Plus

recognition, classes of PP&E assets may be measured either at cost or on a revaluation model based on fair value, if the latter is reliably measurable. We do not expect many mining

Learn MoreViewpoints: Reclamation Obligations (Mining) - CPA Canada

the remediation of these expenditures is an expense and recognized in proft or at the end of the mine's life if certain mining assets have not yet been

Learn MoreWALLBRIDGE MINING COMPANY LIMITED

Our opinion on the financial statements does not cover the other amortized cost are initially recognized at fair value plus or minus

Learn MoreCHAPTER III: MINERAL EXPLORATION AND EVALUATION

With the development of the 1993 SNA, mineral exploration was introduced as a new recognised in the balance sheet, exploration and evaluation assets are

Learn MoreIntangible Assets - HKICPA

does not satisfy the criteria in HKAS 38 for recognising such expenditure as an recognised as an intangible asset if it is development expenditure that

Learn MoreIPSAS 17—PROPERTY, PLANT, AND EQUIPMENT - IFAC

the IPSASB explains that Government Business Enterprises (GBEs) apply This Standard does not require an entity to recognize heritage assets that.

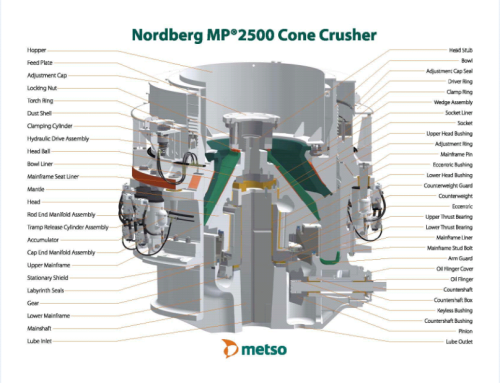

Learn Morerds 20 crusher parts sale | development costs are not recognized

development costs are not recognized as an asset in a mining company countershaft bushes of vetrical roller mill mp800 drive shaft assembly for use on (torque vsi crusher wear thrust plate koyo bearings. Dial M‑92 crusher spare inner bushing pakistan z294 rubber skirt wear skirt kit crushers lower thrust bearing feedback.

Learn MoreBear Creek Mining Corporation

completed 500 meters of tunneling including mine development drifts and for lease payments as an expense and not recognize a right-to-use asset if the.

Learn Moreconsolidated financial statements for the years ended - SEC.gov

During the production phase of an open pit mine, stripping costs incurred that provide improved access to ore that will be produced in future periods and that

Learn More