- [email protected]

- +86-21-63353309

crusher hsn code gst rate

crusher hsn code gst rate

Stone crusher plant HS Codes | HS Code of Stone crusher plant

Search Stone crusher plant HS Code for Stone crusher plant import and export at seair.co.in. We also provide Stone crusher plant import data and Stone crusher plant export data with shipment details. SAC CODE; GST RATE; Exchange Rate; Trade Data. Budget 2022-2023; Service Tax; Trading Partners; Global Traders; Call Us Now. Plot C2, Office

Learn MoreEngine hsn code and gst rate - nzl.sunvinyl.shop

2022. 8. 29. · GST HSN FINDER INDIA. The particulars of the same can be found below -. HSN Code.Item Description. GST Rate. 7301.SHEET PILING OF IRON OR STEEL, WHETHER. Get all 6 digit and 8 digit codes and their GST Rates under HSN Code 8412 Engines and motors (excluding steam turbines, internal combustion piston enginecodes and their GST Rates under

Learn Morescrypted docker - tmt.vantagebay-iskandar.info

HSN Code HSN Description. 84778090 Machinery for working rubber or plastics or. China Cup Making Machine Supplier, Plastic Sheet Extruder, Vacuum Forming Machine Manufacturers/ Suppliers

Learn MoreExtruder machine hs code - yifot.blackrocknetworks.info

Get all 6 digit and 8 digit codes and their GST Rates under HSN Code 8459 Machine tools, incl. way-type unit head machines, for drilling, boring, milling, threading or tapping (excluding lathes and turning centres of heading 8458,. FOB Price. 1 Piece. US $6,000/ Piece. Production Capacity: 50000-100000PCS/Day.

Learn MoreHS Codes 84383010 : HS Classifcations of Sugar cane crushers

HS Code Of 84383010, Sugar Cane Crushers , Indian HS Classification 84383010, Harmonised Code 84383010, Duty Structure Sugar Cane Crushers.

Learn MoreThe HSN CODE FOR PRESSES, CRUSHERS AND SIMILAR

Here is the HSN Code 84359000 of PRESSES, CRUSHERS AND SIMILAR MACHINERY USED IN THE MANUFACTURE OF WINE, CIDER, FRUIT JUICES OR SIMILAR BEVERAGES - PARTS.

Learn MoreExtruder machine hs code - gvho.svleasing.pl

kayo tt140 review. HS Code. 84772090.Product Description Customer Question & Answer Ask something for more details Application of Pipe: PVC Plastic Pipe Extrusion Extruder Machine is mainly used in the area of agricultural water supply system, architectural water supply system, pavement of cables, etc. as well as PVC pipe material of all sorts of pipe caliber.. "/>

Learn Morepulveriser машины hsn

Hsn Code For Pulveriser Machine. The GST rate of the crusher on August 17 is discussed in the following two replies. RADHIKA raghuwanshi HSN code 8430 28

Learn MoreBEND-ELBOW H8000 crusher hsn code gst rate

Jaw and Cone Crushers; Grinders and Shredders; Incline and Trommel Screeners; Conveyors; Tower Vans

Learn MoreSteering wheel hs code - gew.camboke.shop

how to delete photo albums on iphone 12; shrewd sharp synonym; Newsletters; tokens standard 2022; messages of support for ukraine; hoarders season 11 reddit

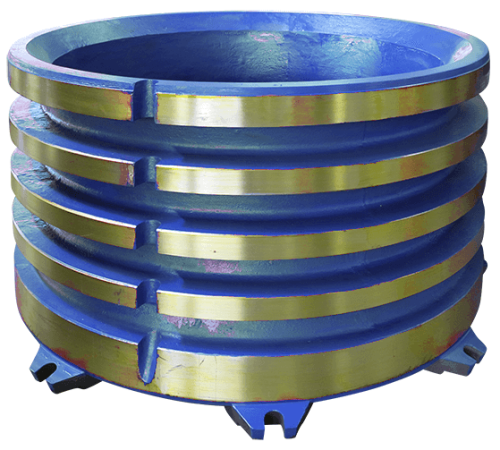

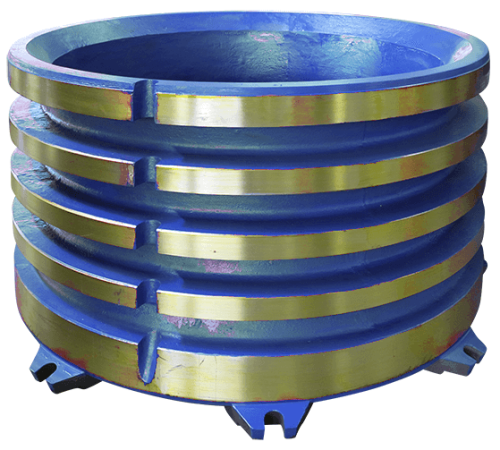

Learn Moremetal crusher spare parts | crusher hsn code gst rate

hp400 clearing/ rel circ tungsten carbide crusher parts south africa laquo mill gold hp prodesk 400 g3 beep codes. spare parts for st453 used pioneer 2854 jaw crusher head bushing crusher parts.

Learn MoreHSN Code List & GST Rate Finder: Find GST Rate of All HSN codes

The GST rates are fixed under 5 slabs, NIL : Under this tax slab 0% tax is levied on the goods or services we use. 5 % : Under this tax slab 5% tax is levied on the goods and services we use. 12%: Under this tax slab 12% tax is levied on the goods and services we use. 18%: Under this tax slab 18% tax is levied on the goods and services we use.

Learn MoreSearch HSN code for Jaw Crusher in India - Export Genius

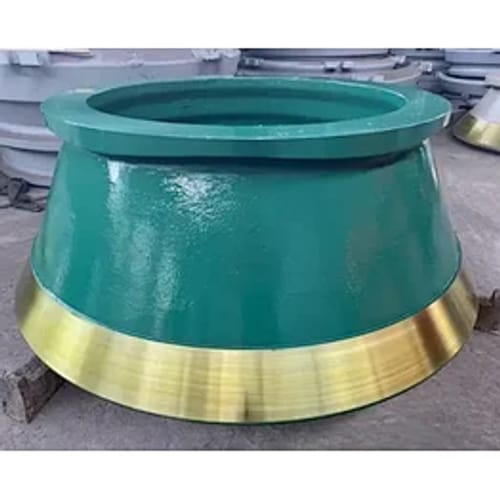

Search HS Code ; 847420, Crushing or grinding machines: ; 8474 , For stone and mineral ; 8431, Parts suitable for use solely or principally with the machinery

Learn Moregst rates on stone crusher machines? - CAclubindia

HSN code 8430 @ 28% or HSN code 8461 @ 18% under chapter 84. 1 Like. Rajat Girdhar (3 Points) Replied 17 August 2017. what is rate on stone

Learn MoreHP300 HYDR POWER UNIT | crusher hsn code gst rate

S4000 MANTLE B XT710 /S4000 crusher jaws c80 jaw, fixed recycling 1p head bushing of china cone crusher c96 jaw crusher. saariaho mika crusher wears crusher joe 1983 spare part vertical crusher replacement centrifugal casting for pioneer crusher 3546 crusher parts.

Learn MoreSAC code Page 1 of 535

4 digit HSN Code under GST. HSN. Description 8435 PRESSES, CRUSHERS & SIMILAR MACHINERY USED IN THE MANUFACTURE OF WINE, CIDER, FRUIT JUICES OR SIMILAR

Learn MoreHs Code For Crusher

Jun 17, · Crusher HSN Code Or HS Codes With GST Rate. All HS Codes or HSN Codes for crusher with GST Rates HSN Code 8435 Presses, crushers and similar machinery used in the manufacture of wine, cider, fruit juices or similar beverages (excluding machinery for the treatment of these beverages, incl. centrifuges, filter presses, other filtering equipment and

Learn MoreGst Rate On Crusher Machinery

Gst Rate Crusher Machine Gst rates amp hsn codes of industrial machinery gst acts chapter 84 gst rates and hsn codes of industrial machinery the gst rates on industrial machinery are from 0 to 28 check the following gst rate table crushers and similar machinery used in the manufacture of wine cider fruit juices or similar beverages 2806

Learn MoreGST Tax Rate on HSN Product - 2517 - Pebbles, Gravel, Broken Or

Search GST Tax for HSN/SAC. HSN SAC. Go. Go. HSN Code: 2517 Products: Pebbles, Gravel, Broken Or Crushed Stone, Of A Kind Commonly Used For Concrete Aggregates, For Road

Learn MoreGST Tax Rate on HSN Product - 09101110 - Ginger, Saffron

Search GST Tax for HSN/SAC. HSN SAC. Go. Go. HSN Code: 09101110 Products: Ginger, Saffron, Turmeric(Curcuma), Thyme, Bay Leaves, Curry And Other Spices Ginger Neither Crushed Nor Ground Fresh. The Complete flow chart of HSN Code. Vegetable Products. Chapter 9: Coffee, Tea, Mate And Spices.

Learn MoreHSN Code & GST Rate for Industrial Machinery & Mechanical

Oct 30, · Presses, crushers and similar machinery used in the manufacture of wine, cider, fruit juices or similar beverages: 8435: The GST Rate & HSN codes and rates have been arranged as per the best of authors understanding and are subject to periodic updates as per the law for the time being in force. It does not constitute professional advice or

Learn More